Goals of Diversification

Diversification stands as a foundational principle in the world of investment strategy, often hailed as a shield against market volatility and risk. Financial experts extol its virtues, emphasizing its ability to spread investments across various asset classes, sectors, and geographic regions to mitigate the impact of market fluctuations. Yet, despite its widely acknowledged importance, achieving true diversification can remain a challenge for many investors.

A well-diversified portfolio is not merely a collection of different investments but a strategic allocation designed to capture upside potential while minimizing downside risk. However, many investors may overestimate the extent of their diversification, particularly those who rely heavily on broad-based mutual funds and exchange-traded funds (ETFs). While these funds offer exposure to a wide range of securities, the current market landscape underscores the need for a closer examination of portfolio holdings.

Identifying Potential Issues

The recent surge in technology stocks, often dubbed the “magnificent seven,” has brought increased attention to the concentration risk inherent in many diversified portfolios. Dominated by giants like Microsoft(MSFT), Apple(APPL), Nvidia(NVDA), Alphabet(GOOG), Amazon(AMZN), Meta(META), and Tesla(TSLA), this select group of stocks has become the focal point of numerous investment strategies. While investing in broad-based funds may seem like a prudent diversification tactic, a deeper analysis reveals a potential flaw in this approach.

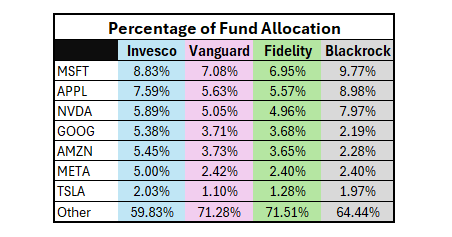

Consider an investor seeking to diversify their portfolio by allocating capital to four different funds: Invesco’s Nasdaq-100 tracker (QQQ), Vanguard’s S&P 500 ETF (VOO), Fidelity’s Large Cap Index (FNILX), and Blackrock’s Technology Opportunities Fund (BSTSX). At first glance, this allocation appears diversified, with exposure to various indices and market segments. The investor has chosen two different indices to track, a fund that focuses on market capitalization and another fund with a technology focus. However, a closer examination of each fund’s holdings reveals a significant overlap.

Despite the apparent diversification across different funds, roughly 33% of the initial investment is allocated to the magnificent seven stocks. The reason for this concentration has to do with the construction of each fund’s holdings. The funds aren’t inherently flawed, but they are weighted on a market cap basis, which tends to skew holdings towards companies with the highest value on a capitalization basis. This technical detail of fund construction may not be foremost on the investor’s mind; however it does greatly impact their holdings. This concentration severely limits the portfolio’s diversification and exposes the investor to risk, should any of these stocks experience a significant downturn.

An Investment Example

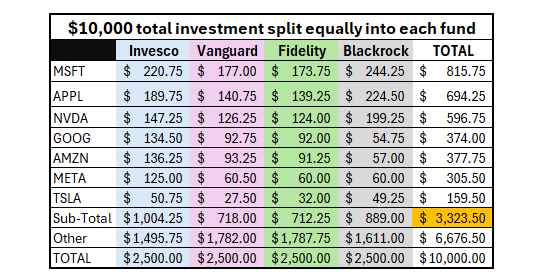

Returning to our example investor, lets imagine for moment that they have $10,000 to invest. Furthermore, they have decided to allocate an equal portion, $2,500 to each of the above mentioned funds, in an attempt to diversify their portfolio. What is the result of their efforts? Are they actually diversified?

As can be seen in the above, roughly $3,300 of their initial $10,000 investment ends up with just seven companies. This investor may understand the importance of diversification for portfolio building but requires further research into their investments. While investing in multiple funds may offer exposure to different sectors and asset classes, the underlying holdings determine the extent of diversification. Without a thorough analysis of each fund’s holdings, investors risk unknowingly concentrating their investments in a handful of stocks, undermining the very principle of diversification.

What can Investors Do?

So, how can investors ensure they are truly diversified? Firstly, it requires a deeper understanding of their investment holdings beyond the fund names. Investors should scrutinize each fund’s top holdings, sector allocations, and geographic exposure to assess potential overlap and concentration risk. Secondly, seeking guidance from financial experts can provide invaluable insights into portfolio construction and optimization.

Financial advisors can offer personalized recommendations tailored to each investor’s risk tolerance, investment goals, and time horizon. By conducting a comprehensive review of an investor’s portfolio, advisors can identify areas of concentration and recommend adjustments to achieve optimal diversification.

Achieving true diversification requires more than just investing in multiple funds; it demands a nuanced understanding of portfolio holdings and their implications for risk management. By conducting thorough research and seeking professional guidance, investors can navigate the complexities of portfolio diversification and build a resilient investment strategy for long-term success.

Your financial success is worth the investment!